By Will Irving

While New Jersey’s payroll employment has continued to grow this year after the rapid job gains of the post-pandemic recovery, a slower pace of growth in recent months and a sharp rise in the state’s unemployment rate, particularly over the last six months, are giving rise to some concern (see this article from NJ Spotlight News for example).

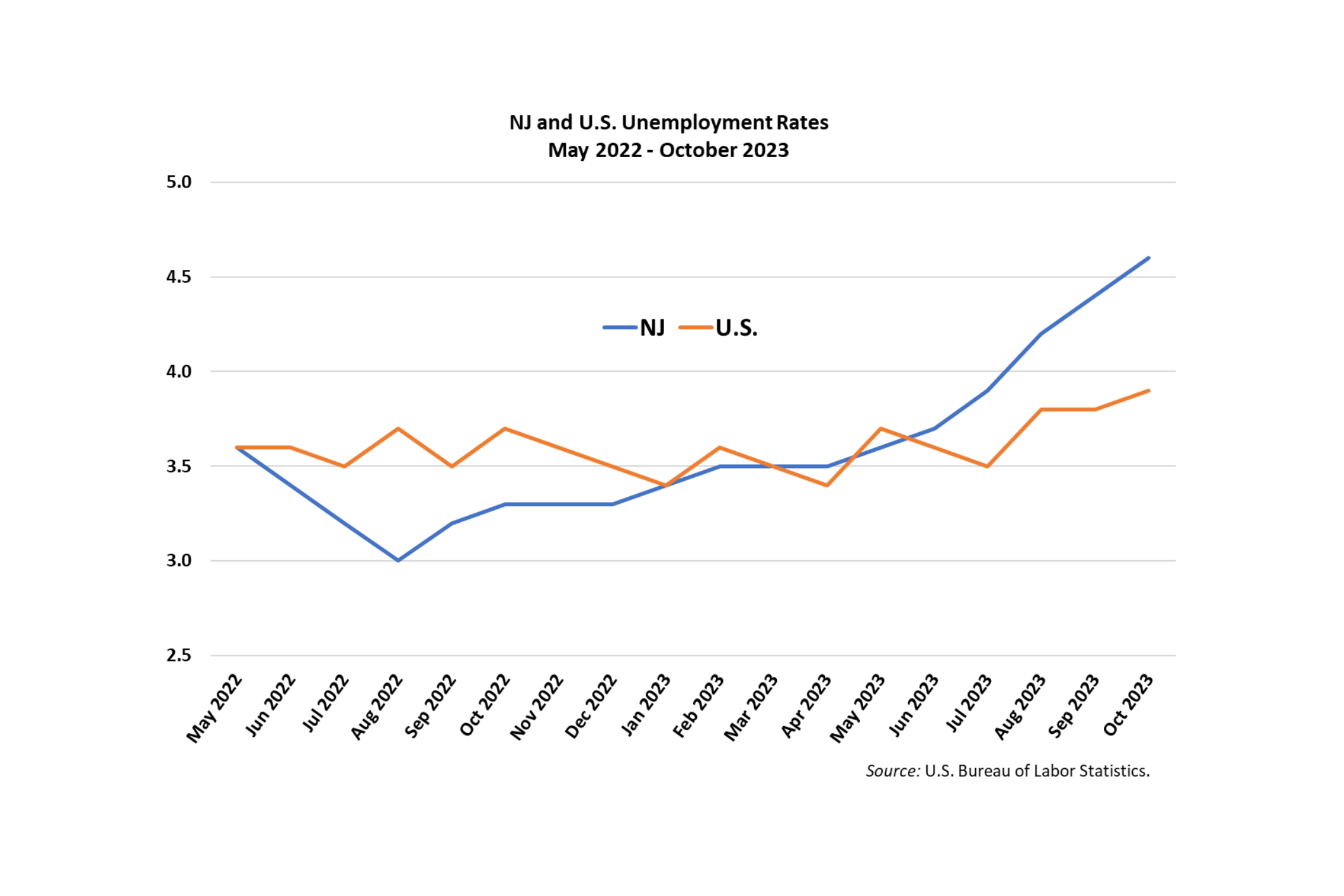

The state’s unemployment rate reached its low of 3.0% in August of 2022, and has since risen by 1.6 percentage points to 4.6% in October of this year. This is the third highest level among the 50 states and by far the largest increase over that period. The national unemployment rate stood at 3.9% in October, up just 0.2 percentage points from August of 2022.

At the same time, payroll employment growth in the state has been relatively steady, declining from the fast pace of the COVID recovery to a level similar to that of the U.S. and other states in the region. New Jersey’s year-over-year payroll employment growth was 2.0% (85,700 jobs) through October, down from 3.4% growth over the preceding 12 months (October 2021 – October 2022).

It is not uncommon to see a jump in the unemployment rate during a period of expansion, as new entrants may enter the labor market faster than they are able to find jobs. However, through much of the COVID recovery, the opposite was the case. From its April 2020 low of 60.6%, New Jersey’s labor force participation rate grew to 64.2% in August of 2022, when the unemployment rate hit its low point of 3.0%. Over that period, while the labor force grew by about 276,000 people, the number of unemployed declined by over 525,000, as temporarily unemployed workers returned to their jobs and those re-entering (or newly entering) the labor force quickly found jobs, driving the unemployment rate downward.

The unemployment rate then ticked upward in the latter part of 2022, as labor force growth stalled and the number of unemployed increased for the first time since a minor uptick in early 2021. Through the first four months of the current year, labor force growth resumed. The number of unemployed also increased, but only moderately, as the job market continued to absorb new labor force participants, with the unemployment rate rising to 3.5% in February and holding at that level through April.

At this stage, some early signs of labor market slackening could be detected in data from the BLS Job Openings and Labor Turnover Survey (JOLTS). The average number of monthly job openings in the state declined from about 300,000 in early 2022 to about 250,000 in the first third of this year, and the number of unemployed workers per job opening – a measure of labor market tightness – began to climb.

Over the last six months, growth in New Jersey’s unemployment rate accelerated, climbing by 1.1 percentage points from 3.5% in April to 4.6% in October. This sharp increase reflected both slowing labor force growth – turning to labor force decline in the last two months – and persistent growth in the number of unemployed. From April to October, while the labor force grew by a net total of just under 26,000, the number of unemployed grew by twice that number – nearly 53,000. At the same time, job openings, which averaged about 250,000 per month through the first four months of the year, dropped to a monthly average of about 223,000 from May through September (October JOLTS data are not yet available). Taken together, these data imply a labor market that is nearing or has reached saturation and is no longer absorbing new workers as they enter the job market.

Data from the last three months (August-October) show an even more pronounced trend in this direction. The labor force has actually declined by nearly 17,000 people over that period, while the number of unemployed has increased by nearly double that number – just over 33,000. Thus, it appears that not only is the labor market not absorbing new entrants into positions, but those already in the labor force are not finding work or are losing jobs.

It is not unusual for the trends in payroll employment and the unemployment rate to diverge over the short term, as they are based on different data collection mechanisms, and the current spike in the unemployment rate has not been accompanied by large payroll employment declines. However, there are mounting signs (though far from definitive) in the labor force and job market trends that may portend a sharper slowing or stagnation in payroll employment growth. Indeed, the state has added fewer than 5,000 jobs to private sector payrolls over the last five months and the most recent R/ECON forecast for the state projects flat payroll employment over the next two years.

At the same time, the R/ECON forecast also projects that the unemployment rate will moderate somewhat from its current level. Additionally, while the data from JOLTS indicate that discharges and layoffs were somewhat elevated earlier in the year, they have since come down, and hiring has been steady. Thus, the underlying picture remains somewhat murky.

While the current rapid rise in the unemployment rate has been unique to New Jersey, longstanding expectations of a soft (or hard) landing for the national economy soon may see other states follow a similar pattern. At the same time, slowing labor force growth and a softer economic landing could moderate unemployment rate growth both in New Jersey and nationally. Trends over the next three to six months will be telling in this regard.