By Michael S. Hayes, Associate Professor, Rutgers University-Camden and Prakash Kandel, Ph.D. Student, Rutgers University-Camden

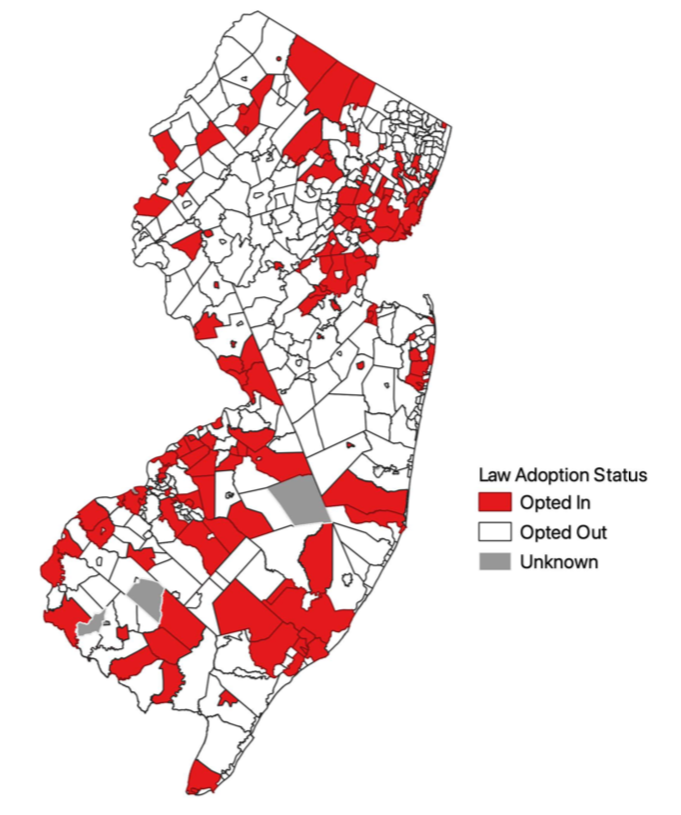

During the 2020 general election, New Jersey voters approved a ballot question to amend the state constitution to allow residents 21 years or older to possess and consume cannabis products. By the summer of 2021, the New Jersey Cannabis Regulatory Commission (NJCRC) had published a set of cannabis regulations, including the rules for starting and locating a cannabis-related business in the state. Importantly, local governments in New Jersey had the option to opt-out of allowing cannabis-related businesses in their jurisdictions. Approximately 60% of all N.J. municipalities have opted out, as shown in Figure 1 below.

Banning local cannabis-related businesses will likely have important economic and social impacts on N.J. communities. It is possible that the banning of cannabis businesses is factored into homebuyers’ decisions to buy in a particular municipality, especially if the homebuyers are concerned that these businesses may cause an increase in crime. This is important because changes in property values can affect local government tax revenues. Therefore, it is vital that state and local policymakers know the impact of allowing cannabis-related businesses on local home prices.

Figure 1. New Jersey Municipalities by Law Adoption Status

Our study’s findings suggest there is a positive relationship between home sale prices and the decision to allow cannabis-related businesses. For example, we find the average home sale price increased by 1.7% more following the deadline to opt-out in municipalities that allowed cannabis-related businesses compared to the average home sale price change in municipalities that did not allow cannabis-related businesses. A 1.7% increase in the home sale price for the average parcel in an “opt-in” municipality is equivalent to a $6,763 increase. Unfortunately, our robustness checks indicate that there is not enough evidence to suggest that the decision to allow cannabis-related businesses caused this home price increase. However, there is suggestive evidence that allowing cannabis-related businesses does not negatively impact home sale prices, at least in the short-run.

There are two broad policy recommendations based on this study. First, it is vital that state and local policymakers continue to collect data and evaluate the impacts of these cannabis-related businesses on individuals and communities. The findings from our full report suggest that the whereabouts of cannabis-related businesses are not randomly distributed across the state. For example, we find that the poorest municipalities and the municipalities with the lowest levels of property values are most likely to allow cannabis-related businesses in their jurisdictions. We do not yet fully understand the benefits and costs of these businesses on local residents and local communities. If future research finds negative social costs on the community from cannabis-related businesses, then these social costs will be absorbed mainly in the most disadvantaged parts of the state.

Second, state and local policymakers in New Jersey can be cautiously optimistic about how their decision to allow cannabis-related businesses is impacting residential property sale prices. Hopefully, this study will provide helpful information to local policymakers in “opt-out” municipalities that are on the fence about allowing cannabis-related businesses sometime in the future, especially if their main concern is regarding how these businesses might impact their property tax base.

A full policy report with finalized results, policy recommendations, and goals for future research has been published by the New Jersey State Policy Lab.